The fintech sector in 2023 has experienced unparalleled expansion, marking its prominent role in the worldwide financial landscape.

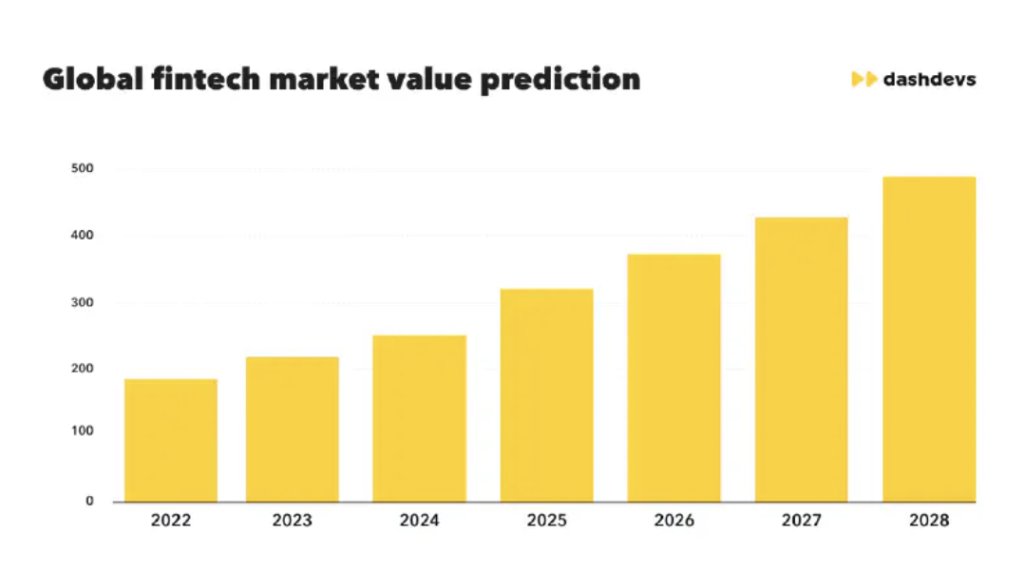

As per EMR's data, the global fintech market reached a significant valuation and is projected to expand at a CAGR of 16.8% during 2023-2028, targeting a market size of USD 492.81 billion by 2028.

The rise in online transactions, the growing appeal of mobile banking, and the emergence of blockchain technology stand as a testament to this fintech metamorphosis. The shift towards a cash-free society and the urgency for on-the-spot financial solutions further fuel the appetite for cutting-edge fintech offerings.

However, amidst the enormous promise the fintech realm presents, there's a core principle to bear in mind: the longevity and triumph of a fintech startup are predominantly influenced by its selected business strategy. This encompasses the firm's unique value offering, target demographic, scalability, and, crucially — revenue generation.

Recent studies indicate that fintech startup profitability might not be as rosy as perceived. Analysis from 2022 reveals that around 400 Neobanks globally catered to nearly a billion users. Yet, a mere 5% of these innovative players achieved the breakeven point.

A Comprehensive Guide to Choosing the Right Business Model for Your Fintech Venture

So, you've landed here with a groundbreaking startup idea. It's unique, it's cutting-edge, and you're convinced it can redefine the industry landscape. But the question arises: how can you mold this idea into a profitable business structure?

Embark on this detailed guide to navigate the path to the ideal business model for your startup.

1. Deciphering Your Market and Client Preferences

Let's kick things off by identifying your audience. Delve into comprehensive market analysis to truly grasp your intended clientele. Move beyond mere age and location demographics; dive into their lifestyles, habits, necessities, and challenges.

The crux is to pinpoint a distinct issue your startup is poised to resolve, ensuring you're attuned to that challenge to drive profitability.

2. Navigating the Regulatory Landscape

The fintech arena, regardless of being situated in the US, UK, or elsewhere, is often bound by stringent regulations. Familiarize yourself with both global and local regulatory mandates that may intersect with your operational framework.

For illustration, the guidelines governing open banking can differ widely across borders. A strategy that's viable in Canada might hit a wall in Switzerland due to regulatory nuances.

3. Assessing Your Tech Blueprint

Your technological framework transcends merely crafting an app or digital platform. It's about ensuring adaptability, fortifying security, and delivering an impeccable user journey. It's vital that the business model you opt for dovetails with the tech backbone you possess or intend to develop.

Say, if you're leaning towards an API monetization strategy, your APIs should be fortified, agile, and expandable to meet anticipated requirements.

4. Gauging Funding and Financial Resources

Distinct fintech business structures demand varying levels of capital commitment. Some may necessitate substantial initial capital, while others could be more cost-efficient.

Evaluate your fiscal health and your capacity to secure investments, opting for a model in sync with your financial roadmap.

5. Strategizing Alliances and Collaborative Ventures

In the fintech domain, partnerships can pivot your business trajectory. Whether it's teaming up with traditional banks for data insights or joining forces with tech giants for seamless integrations, such affiliations can reshape your business blueprint.

As an example, forging a partnership with a big bank might make strategies revolving around API access charges or transactional fees more enticing.

The original content of the note was published on Finextra.com. To read the full note visit here